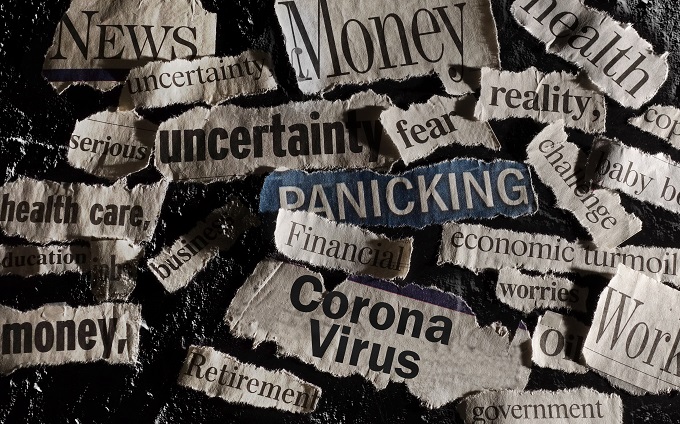

Op-Ed: Shocked. Saddened. We small hoteliers left in the dust by ‘support’ packages

Why do I feel like our small hotel business in coastal NSW has slipped through the handout cracks, leaving us to face pending doom?

The Australian Government has so far unveiled over $320 billion worth of rescue packages to support businesses and individuals deemed to be suffering the economic consequences of the novel coronavirus. But, somehow, we have been excluded.

I have almost daily contact with my accountant to discuss each new assistance package announcement and each one, time and time again, passes us by.

We aren’t entitled to so much as a sneeze.

I don’t want to sound dismissive of the support packages already announced as I’m sure that there is good reasoning behind them all. I admire our Government’s effort to support as many people as possible and stave off this crisis. And I’m sure there’s a lot of grateful business owners and individuals out there.

Like most hotels (unless being utilised in cities by the State Governments for quarantine purposes) we have no guests. No guests mean no income. We can’t afford, nor have work for, our small and wonderful staff.

Our casual cleaner, now unemployed, should be OK though. We weren’t entitled to claim the JobKeeper allowance for her as she was with us five weeks short of 12 months, however on the JobSeeker allowance she will still earn $21 per week more than when she was working 18 hours per week for us.

Our part-time manager, now unemployed, should be OK too. As a contractor and Sole Trader, she will average $1000 a month more on the JobKeeper allowance than when she was working part-time for us.

So what assistance is available for our business, to allow us to still meet such expenses as rates, land tax, business & building insurances, utilities, building and garden maintenance, Booking software subscriptions, etc.? Well the Boosting Cash Flow for Employers Initiative is definitely welcomed by us.

Fortunately, we had transitioned our cleaner to casual and she was on payroll, so we are entitled to $10,000 credit toward our BAS. Subtract our average BAS debt though, and we can look forward to maybe $6000 benefit. This is to see us through until the next quarter.

Six-thousand dollars (equating to $250 week each for my husband and I) for all our business expenses plus our personal expenses. Because neither of us were on the payroll, instead taking drawings as required, we aren’t entitled to any other assistance. No Jobkeeper or Jobseeker allowance for us. Somehow that $250 per week each will also need to meet our personal costs -: rates, home/health/car insurances, rego, utilities and food!

Should we be appreciative that, when we fall into the debt as we inevitably will, that creditors can’t issue a statutory demand on our company for a few months? Should we be appreciative of the Instant Asset Write-Off threshold increase or the Accelerated Depreciation changes? I don’t foresee us investing in our business or acquiring assets without an income so I’m not sure how to best utilise this initiative. Perhaps we should be appreciative that the government will support and encourage the banks, through the SME Guarantee Scheme, to lend us money to get through this period; however, it’s hard to look forward to acquiring a debt to merely cover our expenses.

My husband and I are fortunate. We don’t have a home or business loan. I’m not sure that too many other small hotel owners are so lucky. If we are filled with fear and dread for our financial future, how on earth are other business owners feeling?

Update: Friday morning our Federal Member called me (Kevin Hogan) in response.

He had heard of others not being entitled to anything due to not being on payroll, however encouraged us to apply for JobSeeker allowance – albeit not at all sure if we would meet the criteria. As such I spent over an hour trying to do just that however with typical business structures of trusts and companies, this is an agonizing process and one that I still am not confident will work due to the ‘value’ of our freehold hotel land and buildings.

He asked me to update him if I have any luck but agreed that the Federal Govt. need to look into this further due to businesses like us who have slipped through the cracks.

Jacqui and Charlie purchased Clubyamba Holiday Villas 21 months ago, their first foray into the accommodation industry. An ex-teacher and a maintenance fitter, Jacqui and Charlie raised their three children on the QLD Sunshine Coast, where they bought their first business, a successful organic butcher shop, 10 years ago. Just a year after selling in 2017, they purchased a freehold hotel in Yamba NSW, the town where they had both grown up. With elderly parents still in the area, they wanted to live and work close by.

Great article, in the same boat myself, loans are being covered by the banks for 6 months but all the running costs will still be out of my pocket. Company in a trust and only employ a cleaning subcontractor. As i only draw income from the trust not eligible for anything. I bet if i try jobseeker for any income they will say my (bank owned) assets are too high!

Same … the bank owned assets do us in as well! And, having experienced difficulties last year with my husband off work because of open heart surgery for 4 months, where the bank very kindly suspended our business loan payments for 4 months … I know that at the end of that time, the whole lot falls due! Nearly killed us financially!! Now this, a month or so later! Our small leasehold motel business unlikely to survive!

Peter Wilson

Worse position for us as we are leaseholders and have the added burden of still needing to find 20k per month rent to owner on top of of all other outgoings. We will have to suck it up and see how far we get before folding. We are finding it difficult to approach this situation with any degree of confidence, however mu heart goes out to the properties in towns affected by drought then fires and now no business to rebuild with. They find may themselves in a far more dire predicament than us,

Peter I am in that situation. We have been decimated by 3 years of drought followed by massive last minute cancellations due to the bushfires and now this. We were not entitled to any of the funding for those disasters yet they pretty much ruined us. If I was a farmer, good or bad, I could get up to $500k interest free from the Gov to help me out but as a Motel , nothing. I had every booking for the rest of the year cancel within 3 days. I wrote to Barnaby Joyce last week to point this out and to his credit he took the time to give me a call, he was shocked, then sent me a link to the government funding which unfortunately we are not entitled to. Tax relief with no cash flow is nothing. No bank will lend to a business who has been through what we have as our cash reserves were already depleted by the first two disasters. We don’t want charity, just the chance to dig our own way out of this mess, just as the farmers are offered. Borrowing money is the last thing anyone wants to do but sometimes it needs to be an option. As I tried to explain to Mr Joyce, desperate people make desperate decisions which are more often than not, wrong. But when forced into predicaments like this it is often the result. Our industry needs to band together and get these points across to the Government before our livelihoods are completely ruined.

I am in a similar position in that we own the freehold, but we have no staff. We are a true mum and dad company. My Federal Member and accountant has advised that 1 of us can get the keeper and the other the seeker??? I hope we get something, because as a non employing company operating within a trust – we get nothing else!!! People with our company structure have either been ignored, forgotten or simply not recognised. We need to eat too…

My partner and I are in the same boat but we dont have loans the banks can allow to skip payments. If you are a dolie you already have your handout but if you are a small accommodation business you have to wait and jump through the hoops to get anything if anything is available for you. They know the motel industry is down because it was the government who have told people not to travel. They could give a handout to all motels and sort out who was eligible later and ask for it back. There are plenty of public servants who we are still paying for in employment who can do the paperwork.

My partner and I are in a similar boat but we do have big loans, luckily they have been deferred for 6 months.

On a different item altogether i would like to know if the governemnt can step in where booking.com and similar are concerned as they are extorting huge amounts of money from us all with what seems very little effort. We have to pay them anything between 15 – 22 % to try to get noticed but they are doing this to everyone so effectively driving up there percentages and taking from from our owners..

I would like to see the government put a topping on the likes of these companies so the most they can take from us is 15% at most. ??

Peter Wilson

Worse position for us as we are leaseholders and have the added burden of still needing to find 20k per month rent to owner on top of of all other outgoings. We will have to suck it up and see how far we get before folding. We are finding it difficult to approach this situation with any degree of confidence, however mu heart goes out to the properties in towns affected by drought then fires and now no business to rebuild with. They find may themselves in a far more dire predicament than us,