Tax implications of JobKeeper for accom sector

The tourism accommodation sector is calling on all state and territory governments to remove additional taxes and charges on JobKeeper payments, to ensure that businesses can retain their connection with close to 100,000 employees in the sector.

“The Federal Government has stepped up to the plate with this wage subsidy, recognising that businesses across Australia value their employees and yet do not have the cashflow to retain employees during a period of zero demand,” said Dean Long, CEO Accommodation Association.

“The stated purpose of JobKeeper is to keep an employer connected to the business, so businesses are in a position to bounce back and contribute to the economy post-COVID 19.”

Today the Treasurer announced that the big four banks had agreed to special measures to help businesses pay their staff in the period before the payments arrive in the first week of May. These measures were: A ‘dedicated hotline’ for businesses to get their hands on “bridging finance”, and Expediting the processing of all those applications to the front of the queue.

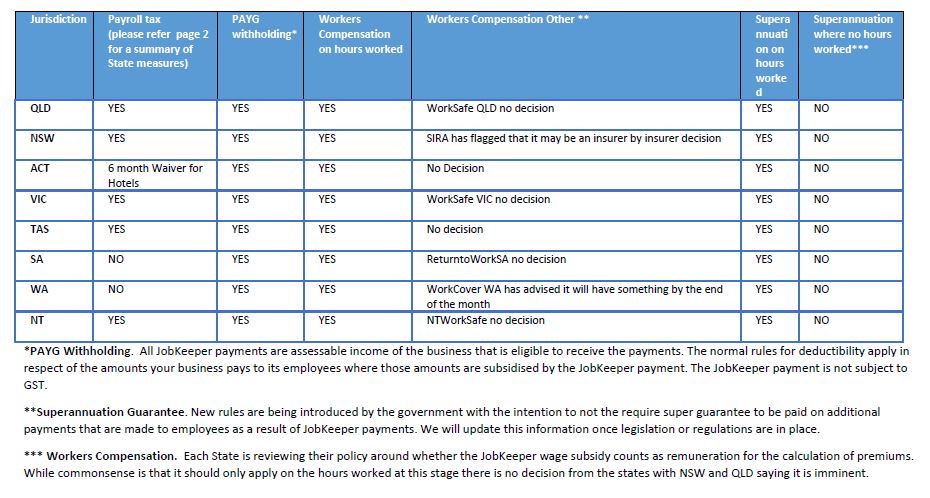

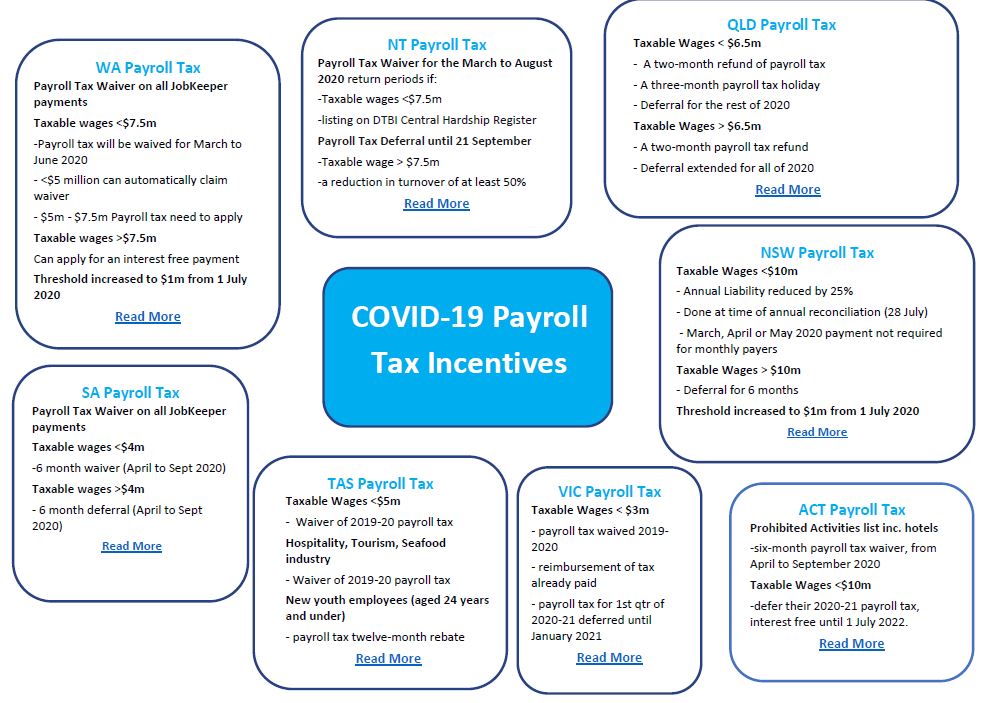

The below table provides a summary of Government taxes and charges you may need to pay if you agree to participate in the JobKeeper Program.

“Unfortunately while states have been supportive of small business they are inconsistent in overall response, imposing taxes and charges on the Federal Government stimulus that act as a disincentive for employers to put their staff onto JobKeeper”, said Mr Long.

“States such as South Australia and Western Australia have demonstrated leadership in waiving the payroll tax on JobKeeper, but there is a lack of consistency across other states response.”

“Equally workers compensation premiums should only be paid on the hours worked, not on the total JobKeeper payment. We are simply seeking a commonsense response that recognises that where there is no risk there is no payment.”

Tourism accommodation businesses have seen revenue falls of between 80% and 85% across Australia with 68% either closed or being utilised for essential services according to the recent ‘Australian Hotel Industry Sentiment Survey, Impact of COVID19’’ report released by AHS Advisory and Horwath HTL in conjunction with the Accommodation Association.

The report highlighted that the impact of COVID-19 is expected to be long term. The majority of respondents pointed to a bleak outlook for Q2 and Q3 with some small improvement in Q4 2020 subject to the easing of restrictions and government investment in driving domestic demand.

“The wage subsidy is critical for our sector. As an industry we want to do the right thing and retain employees so that industry can bounce back when demand lifts. We call on all State and Territory governments to support industry’s efforts by removing inequitable taxes and charges.”

AccomNews is not affiliated with any government agency, body or political party. We are an independently owned, family-operated magazine.