Op-ed: Will staggered return to offices threaten CBD hotel recovery?

Ross Beardsell and Vibhor Kalra look at new JLL research that demonstrates correlation between office occupancies and CBD hotel occupancies

When social commentator Ronald Conway published his 1978 book Land of the Long Weekend the title referred to Australian workers’ perceived laissez-faire attitude to work practices. Little could he have imagined it would be applied to Australia in 2022, as many office workers forsake a return to the office in preference for working from home.

The latest Property Council of Australia (PCA) research shows that central Melbourne’s office occupancy for August remained at just 39 percent, while Sydney stalled at 53 percent. Both cities registered a mere one percentage point rise from July, despite virtually all COVID-19 restrictions being removed.

Our latest AccomNews print issue is available now! Read it HERE.

The implications for the CBD hotel and hospitality sector are obvious, as city hotels rely heavily on corporate travellers, and if there is no one in the office to meet, it decreases the need for interstate or international travel to attend face-to-face meetings.

This translated directly into lower performances by hotels, particularly in Melbourne. STR data showed that Melbourne hotel occupancy dropped to 59 percent in August, while average daily room rates were tracking 27 percent below pre-pandemic figures.

Lower occupancies also reduce revenues for hotel restaurants, bars, function facilities and ancillary services.

Other capital cities performed slightly better, but the PCA figures showed that even if workers returned to the office, it was often for just three days a week, with Friday and Monday most popular for working from home. This was particularly the case in Canberra, where office work is the dominant industry.

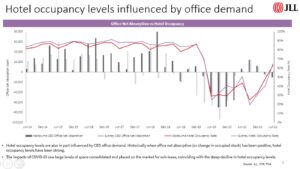

The correlation between office occupancies and CBD hotel occupancies has been demonstrated clearly in new research undertaken by JLL.

Sydney began to recover after borders opened, but a resurgence in COVID-19 via Omicron in mid-year stalled the return to the office and led to a similar flat-lining in corporate travel and conferences.

Hotel occupancy levels have always been influenced by CBD office demand, and while the exodus from cities caused by COVID-19 was understandable, the table below suggests that hotels are going to take considerably longer to return to pre-COVID occupancies while office demand remains muted.

The situation has been compounded by the share market decline of the technology sector, one of the biggest drivers of corporate travel prior to the pandemic. In recent months, global technology companies Google and Microsoft indicated they were likely to reduce spending on business travel and employee gatherings in response to sharp falls in their share prices.

Do the changed market conditions fundamentally alter the business rationale for many of the new city hotels coming on stream?

All the hotels opened over the past few years and those in the pipeline to open over the next two years were developed based on pre-COVID assumptions that not only included ever-rising corporate and conference travel, but also 1.4 million annual Chinese inbound travellers.

This could mean a fundamental reset for CBD hotels and may require adapting facilities and services to the changing traveller environment.

The rise of lifestyle hotels is a direct manifestation of the new travel landscape. Many former corporate-centric hotels have already started the transition, targeting the leisure and ‘bleisure’ markets due to Australians remaining hesitant about travelling overseas for holidays.

This can mean changing food and beverage offerings, adapting spaces to better suit the changing market, partnering with local experiences, targeting suburban markets and even altering their service styles.

The silver lining for CBD hotels is that while occupancies may remain in the 60 – 70 percent range compared to 80-plus percent prior to COVID-19, rates have continued to grow in most cities as leisure guests opt for higher room categories, including suites.

There are positive signs for occupancies. The dropping of masks on planes and in most public spaces has created more ‘normal’ travel conditions. Many CBD hotels are reporting growing interest from companies planning celebratory end-of-year functions, buoyed by positive company results.

Still, there are those who feel the working landscape will never reset to pre-COVID times, but just as the hotel buffet was meant to disappear because of the pandemic, the lure of travel for corporate warriors will inevitably return.

Hotels just need to keep ahead of the game.

Ross Beardsell and Vibhor Kalra are Senior Executives with JLL Hotels & Hospitality Group

Ross Beardsell has over three decades of experience in the hotel industry in senior management roles in operations and development. Working initially with Southern Pacific Hotels, then IHG and the Carlson Group, Ross worked in GM positions across the Asia Pacific. In 2008, he joined JLL’s Hotels & Hospitality Group, providing asset management services on behalf of hotel owners to maximise profitability and to provide strategic guidance. He has provided hotel advisory services to the owners of luxury, upscale, mid-market, new hotels, limited-service accommodation, resorts, convention hotels, and pubs – both nationally and internationally.