Top travel perks for credit cardholders in 2023

Corporate Traveller reveals the top domestic and international travel perks from rewards credit cards that can save your business $$$

This year’s strong demand for domestic and international travel has also seen a resurgence in the accumulation of rewards points. As the cost of living and doing business continues to increase, there are a plethora of exciting travel perks linked to rewards credit cards that might motivate business travellers to take advantage of.

Tom Walley, Global Managing Director at Corporate Traveller says: “The domestic and international travel perks offered by rewards credit cards can save businesses and their travellers hundreds of dollars each year, while allowing them to get a little luxury into their trips without the cost.

These perks include free flights and airport lounge access, restaurant credit and hotel rooms, travel insurance, and even concierge services.

Our latest AccomNews print issue is available now. Read it HERE

“However, travellers should determine the offers that will be of most value to them – and crunch the numbers to work out whether these offers still provide value against sometimes higher interest rates or high annual fees.”

Below, Corporate Traveller has carried out research to reveal eight perks for credit card holders looking to maximise their travel and destination experiences:

1. Complimentary return flights. With airfares likely to remain high in 2023 before capacity returns to pre-COVID levels, some frequent flyers might be attracted to cards with offerings such as up to $450 in travel credit with major airlines or complimentary flights each year. However, cardholders should be aware of any higher-than-average costs associated with those cards. The American Express Velocity Platinum credit card includes one free return domestic flight with Virgin Australia every year and 21.99 percent interest compared with the average credit card interest rate of 19.94 percent The American Express Platinum charge card offers $450 in yearly travel credit to spend on eligible flights, hotels, or car hire, and comes with a $1,450 annual fee.

2. Uncapped points. Many rewards cards put a cap on the points that cardholders can earn each month or year. Businesses with multiple travellers or high-spending directors, once they crunch the numbers and understand how many points they could accumulate, might consider switching to a rewards card offering uncapped points. An example is the NAB Rewards Business Signature Credit Card. Rather than linking to a frequent flyer program, however, this card earns NAB Rewards, which can be redeemed for flights online.

3. Dining credit. Another rewards perk is credit with overseas and domestic restaurant partners, which might appeal to travellers with a tight personal budget while travelling. The American Express Platinum charge card, for instance, offers up to $400 in restaurant credit at participating restaurants in Australia and overseas, but does come with an eye-watering $1,450 annual fee.

4. Earning points on taxes. Some credit cards offer points for tax payments – albeit at a lower awards rate. Businesses should weigh up the redemption value of those rewards with the credit card surcharge for tax office payments. For instance, the American Express Business Explorer card reduces its usual two points for every dollar spent offering to one point with the ATO and against a 1.45 per cent surcharge for tax office payments.

5. Access to airport lounges. Airport lounges offer opportunities to relax or work productively while in transit, and many rewards credit cards offer access to lounges across Australia and internationally. For instance, the HSBC Star Alliance Credit Card allows members to earn points across 26 airline rewards programs, providing access to more than 1,000 airport lounges worldwide. However, cardholders earn one Star Alliance point per $1 spent up to $3,000 per statement period, and just 0.5 points for every $1 spent thereafter. The Qantas Premier Titanium card offers new cardholders two complimentary Qantas First Class lounge passes at selected airports in Sydney, LA, and Melbourne annually – but cardholders need to consider the $1,200 annual fee. The American Express Velocity Platinum cardholders receive two Virgin Australia lounge passes at selected domestic airports each year – but comes with 21.99 percent interest rate and does not allow balance transfers.

6. Travel Insurance. Some rewards credit cards allow cardholders to save on travel insurance by offering a level of complimentary insurance. However, keep in mind there are limitations to a card’s insurance policy, and businesses should determine whether they require more comprehensive cover to ensure employees and business belongings are fully protected. For instance, ANZ Rewards Platinum credit cardholders can access unlimited overseas emergency medical. It caps other cover at $50 for meals and $250 for accommodation in the event of travel delays; $4,000 for lost, stolen or damaged computers, cameras, and video cameras; and up to $1,000 for any other item. However, cover for rental vehicle damage is capped at $5,000.

7. Complimentary accommodation. High-earning travellers who frequent a preferred hotel or want to tack a personal trip onto a business trip might find value in complimentary accommodation. The Citi Prestige Credit Card] allows cardholders to get a fourth night free at a participating hotel, limited to four stays a year, keeping in mind there is a $700 annual fee from the second year and cardholders need to have a minimum $150,000 annual income.

8. No-fee frequent flyer membership. Some rewards credit cards waive rewards membership fees. The HSBC Platinum Qantas Credit Card, for instance, waives the $99.50 Qantas Frequent Flyer membership fee; however, cardholders are limited to earning 0.5 Qantas Points for every $1 spent after spending $1,000 in a statement perio.

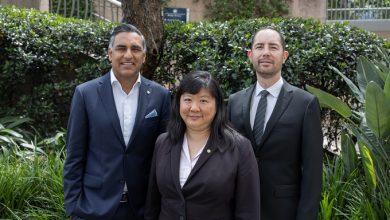

Tom Walley, Global Managing Director at Corporate Traveller Australia, the SME travel division of Flight Centre Travel Group and Australia’s only travel management company dedicated solely to serving the travel needs of the SME market.

Having worked with hundreds of organisations including customers and supplier partners, Tom has an in-depth understanding of the SME business sector and what is needed to drive growth and profitability.

General Advice Disclaimer

This article is intended to provide general information only, and not financial or credit advice. Before acting on any information in this article, you should consider your individual and business circumstances, and seek independent and professional legal, financial, taxation, credit or other advice to help you determine whether these actions are appropriate for your needs. Corporate Traveller provides information about travel products and benefits. We’re not suggesting or recommending a particular credit product for you. If you decide to apply for a Credit Card, you will deal directly with the provider, not with Corporate Traveller. We endeavour to ensure that the information in this article is current and accurate, it’s important you check rates and product information directly with the credit card provider.

American Express Velocity Platinum Card, americanexpress.com/au/credit-cards/velocity-platinum-card/

Compare the Market, comparethemarket.com.au/blog/press-release/with-credit-card-interest-rates-not-budging-australians-take-matters-into-their-own-hands/

American Express Platinum , americanexpress.com/au/credit-cards/the-platinum-card/

NAB Rewards Business Signature Card, nab.com.au/business/business-credit-cards/nab-rewards-business-signature-card

American Express Platinum, americanexpress.com/au/credit-cards/the-platinum-card/

American Express Business Explorer, americanexpress.com/au/business/business-credit-cards/business-explorer-card/

HSBC Star Alliance Credit Card. hsbc.com.au/credit-cards/products/star-alliance/

[8] Qantas Money, qantasmoney.com/credit-cards/premier-titanium

American Express Velocity Platinum, americanexpress.com/au/credit-cards/velocity-platinum-card/

ANZ Rewards Platinum, anz.com.au/personal/credit-cards/rewards/platinum/

Citi Prestige, citibank.com.au/credit-cards/citi-prestige

HSBC Platinum Qantas, hsbc.com.au/credit-cards/products/platinum-qantas/

AccomNews is not affiliated with any government agency, body or political party. We are an independently owned, family-operated magazine.