Tour tourism ‘era’ ignites in Australia

And dont just expect domestic travellers, be prepared for a huge surge of international Swifties chasing their “Wildest Dreams”

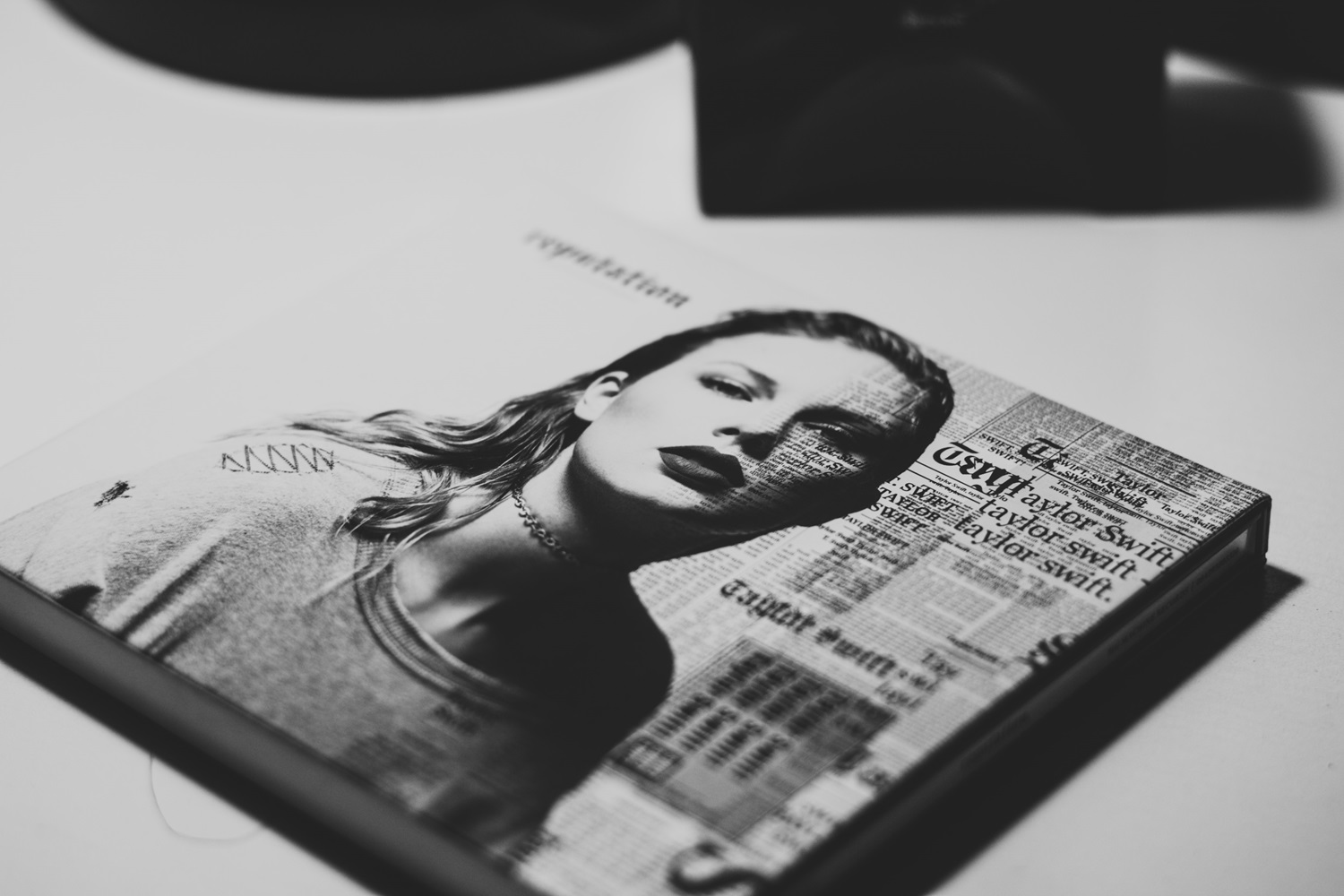

Taylor Swift’s groundbreaking Eras Tour has proven to be nothing short of a “Love Story” for the travel industry, bringing billions of dollars to economies around the world[1].

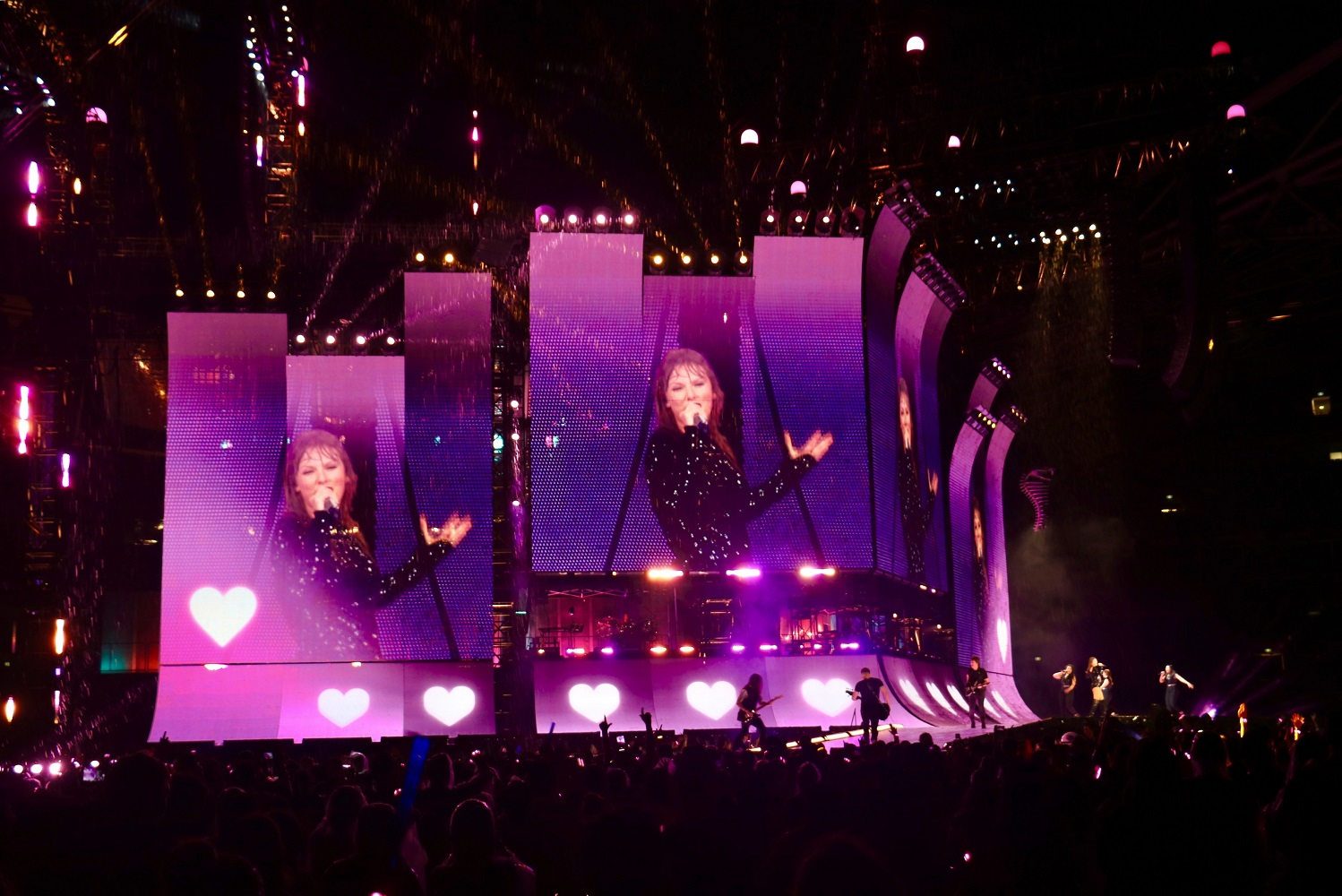

Now it’s Australia’s turn, with a sold-out run of shows in Sydney and Melbourne over two weekends this month marking the official arrival of the ‘tour tourism’ travel trend Down Under.

Read the summer print edition of AccomNews HERE

We actually predicted that ‘gig getaways’ – the idea that concertgoers are increasingly willing to travel for their favourite musical artists – would soon be massive in our Unpack ‘24 Report, released late last year.

So, how will all this impact the Aussie tour tourism market?

It’s predicted that the pop star’s seven concert performances will inject more than $140 million into the local economy[1], and looking at recent Expedia Group search data at the time of the tour’s ticket sales[1] we can see how.

With the Eras Tour only hitting two of the nation’s capital cities, it’s little surprise that there was a surge in domestic travel. What was a surprise though, was the spike in which it came.

Brisbane took out the top spot for Sydney and Melbourne with an increase of 890 percent and 860 percent respectively – both nearly nine times higher than the same travel period in 2023. Both destinations also saw a rise in searches from travellers from Perth (600 percent and 780 percent) and Adelaide (515 percent and 620 percent).

Even locals in each city have chosen to make a weekend of the gig by looking to book an overnight stay (95 percent and 235 percent respectively) following the three-hour-long show.

But it’s not just domestic travellers that are coming to chase their “Wildest Dreams” for the Australian leg of the tour. A huge surge of international Swifties will also be travelling to Australia, with many fans who missed out on getting tickets in their home countries making the trek.

New Zealand dominated the inbound market with a whopping 835 percent increase in searches for Melbourne and 1265 percent increase for Sydney – that’s over 13 times more than the same period last year.

Australia’s Trans-Tasman neighbours weren’t the only market that saw an increase though, with travellers from as far as the United States, Canada and Great Britain also embracing the tour tourism trend with massive spikes in searches to both capital cities[5].

But what does all of this mean, and how can hoteliers get in on the action during an unprecedented and highly competitive period?

With the tour creating a massive influx of travellers to Australia’s largest capital cities, it’s more important than ever for accommodation providers to do everything they can to effectively capture demand. And one of the best ways of doing this is by targeting high-value travellers.

These are the people who travel more often, spend more money and stay longer than your typical jetsetter – meaning they’re a valuable group to attract. That’s why simply understanding the type of traveller they are and being able to offer them a competitive rate through package promotions and mobile deals is a great place to start.

Studies show that travel package promotions –which allow guests to bundle their hotel, flights, and car rentals at a discount–are a major means of boosting hotel revenue and attracting high-value guests.

The act of offering the convenience of finding everything they need in one place has proven successful for Expedia Group-listed properties in the past, with our research showing that the average daily rate for package stays is higher than for standalone stays by an average of 30 percent[6].

It’s not just packages that provide a solution to increasing bookings, though. It’s also about understanding where travellers book. A number of bookings on our brand platforms come from customers using the mobile app, which is why our hotel partners have seen huge benefits from incentivising travellers with mobile-only rates.

With mobile often the preferred channel for last-minute bookings, offering discounted rates to travellers searching on a smartphone means you’re reaching those that are ready to book. Tapping into these on-the-go travellers therefore improves visibility and drives more bookings.

So, at a time when a competitive edge is needed most, it is essential for hoteliers to be smart with their distribution strategy, and I encourage all to take advantage of this demand and make themselves a standout by understanding who their high-value travellers are and what they want.

Because with so much competition out there, hoteliers should do all they can to tell travellers “You Belong With Me”.

[2] Expedia Group Unpack ‘24 Report, 2023

[3] According to reports from Venues NSW, February 2024

[4] Based on Expedia Group search data for the period of June 28 to July 12 2023 & January 1 to January 12, 2024

[5] Sydney search data for inbound markets: Canada (75%), the United States (45%), Korea (15%), and Great Britain (5%). Melbourne search data for inbound markets: United States (370%), Canada (235%), Hong Kong (145%), and Great Britain (70%).

[6] Expedia Group: Distribution Strategy

Michael is leading the team who manages Expedia Group’s lodging inventory across Asia Pacific. In this role, he works with lodging supply partners to maximize their success and potential on the Expedia Group platform and stay ahead of digital innovation. He also works with peers across Expedia Group to create great traveller experiences and be an advocate for the APAC region. Michael joined Expedia Group in 2015 as Representative Director. In his seven-year tenure with the company, he has built a unique B2B knowledge that can benefit all supply partners as they charter the complexities of the travel ecosystem. Prior to joining Expedia Group, Michael worked at Microsoft where his last role was Director of Corporate Accounts.

Michael holds a degree in Applied Mathematics from M.I.T. He was born in Okinawa (Japan) and raised in the U.S. from the age of 7.