Op-Ed: Australian hotel operators reveal positive sentiments for 2023

JLL Hotels & Hospitality’s Ross Beardsell says Australian hoteliers are forecasting a buoyant year ahead

We end 2022 and commence 2023 with a sense of unity in the industry that belies the economic pessimism coming out of some world capitals.

While the recession may be the talk in America, the UK and Europe, the response to JLL Hotels & Hospitality’s Australian Hotel Operator Sentiment Survey highlights a sense of optimism for continuing strong performances in the year ahead.

Certainly, operators acknowledged that concerns remain about labour shortages, increased operating costs and sluggish corporate and inbound travel, but with the continued rebounding of the domestic leisure travel segment, a return of conferences and events, and the costs of international travel keeping most Australian vacationers at home, the consensus was that our industry will come out on the positive side of the ledger in 2023.

This was our inaugural Australian Hotel Operator Sentiment Survey, which was conducted in October 2022. We surveyed 30 key international and domestic hotel operators within Australia, and they were invited to share their insights on the sentiment and trends shaping the hotel landscape.

Significantly, almost all operators shared similar sentiments reflecting in part the industry support of the proposed amalgamation of the two largest hotel accommodation bodies, Tourism Accommodation (TAA) Australia and Accommodation Association (AA).

In previous economic crises a fracturing of the market caused by downturns has usually led to sharp falls in rates as hotels undercut each other making it even more difficult to rebuild rate when conditions improved.

In contrast, survey responders reported that owing to strong ADR performances and improved operating efficiencies, most markets are already seeing year-to-date Gross Operating Profit levels back to full-year 2019 results. The only exceptions are Sydney, Melbourne and Perth which are lagging slightly behind and will likely return to full-year GOP levels over 2023, as corporate travel recovers and inbound flights become more affordable for travellers.

Not surprisingly, over 80 percent of respondents indicated that labour and staffing shortages remain the critical challenge facing the industry, and most likely to hamper GOP performance in 2023. Currently the highest job vacancies include F&B staff, housekeepers and managers. However, it is expected that the return of inbound migration and steady recovery of overseas students and migrants should see these vacancies begin to be filled over the short term.

Other key themes identified in the survey include:

- In line with trends experienced in the UK/Europe and Americas, operators have increased focus on sustainability, with 79 percent of respondents contemplating implementing new ESG initiatives. ESG is now a number one priority in hotel operations across the country. Operators are seemingly on the front foot when it comes to ESG and implementing action plans, with only 16% of respondents having not mandated any ESG initiatives in their corporate accounts.

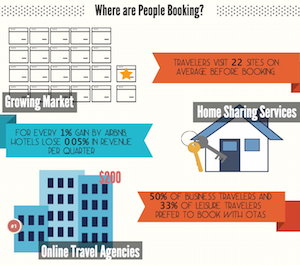

- 68 percent of respondents are looking to improve guest experience and efficiencies with the use of new or innovative technologies. Hotel technologies continue to accelerate post-COVID, with major new functions set to be introduced by operators including: new initiatives to promote direct bookings through proprietary channels (35 percent), contactless F&B ordering and payments (23 percent), energy management and real time building level energy monitoring (22 percent) and keyless digital check-in and mobile entry (17 percent).

- 68 percent are considering the opportunity for possible refurbishment and/or repositioning upgrades. As the unprecedented supply cycle nears its end, it is anticipated there will be a shift away from new development and a renewed focus towards refurbishment and repositioning of existing assets. This is being mirrored by investors who are seeking strong upside potential, through refurbishment, rebranding or value-add opportunities, as well as the conversion or complete redevelopment of older assets.

- The return of workers and reactivation of CBD offices remain critical to the steady recovery of the corporate segment of the hotel market and is key to the sustained performance and growth of city hotels moving forward. Despite the rise in flexible working and the somewhat staggered return to the office, corporate travel and in-person conferences are showing some signs of recovery to close out the year and this momentum is anticipated to continue into 2023. This sentiment is being mirrored by most operators, with close to 80 percent of operators are expecting residential conferencing to recover to 2019 levels over the course of 2023.

- Despite increased air travel facilitating the return of overseas holiday making, together with some concerns over consumer confidence levels, operators are of the view that this will not negatively impact regional markets over 2023. Over 70 percent of respondents anticipate RevPAR in regional markets to either remain the same or continue to increase over the coming year.

- While 2022 has set the scene for recovery, JLL Hotels Operator Sentiment Survey provides an encouraging outlook for 2023 for continued recovery and growth.

For more insights on current hotel operator sentiment within Australia and the key themes that are shaping the market into 2023, download the report here.

Ross Beardsell has over three decades of experience in the hotel industry in senior management roles in operations and development. Working initially with Southern Pacific Hotels, then IHG and the Carlson Group, Ross worked in GM positions across the Asia Pacific. In 2008, he joined JLL’s Hotels & Hospitality Group, providing asset management services on behalf of hotel owners to maximise profitability and to provide strategic guidance. He has provided hotel advisory services to the owners of luxury, upscale, mid-market, new hotels, limited-service accommodation, resorts, convention hotels, and pubs – both nationally and internationally.